Lesson 10

Tax and Tip

10.1: Notice and Wonder: The Price of Sunglasses (5 minutes)

Warm-up

The purpose of this warm-up is to introduce students to the meaning of sales tax.

Launch

Arrange students in groups of 2. Tell students to think of at least one thing they notice or wonder. Display the problem for all to see and give 1 minute of quiet think time. Ask students to give a signal when they have at least one thing they noticed or wondered.

Student Facing

You are on vacation and want to buy a pair of sunglasses for $10 or less. You find a pair with a price tag of $10. The cashier says the total cost will be $10.45.

What do you notice? What do you wonder?

Student Response

For access, consult one of our IM Certified Partners.

Activity Synthesis

Ask students to share what they noticed and wondered. Record and display the responses for all to see. Students are likely to notice that the total cost is more than the price listed on the sunglasses. Ask students to share why they think the amount shown on the cash register is more than the price of the glasses. Ask them if they have ever heard of sales tax before, and if some have, ask them to share their understanding.

Tell students that sales tax is a fee (an amount of money) paid to the government. The amount of tax is a percentage of the price of the item. Different states charge different sales tax percentages, and additionally some local governments like counties and cities also charge a sales tax.

To start to help make sense of how sales tax works, ask questions like:

- How much sales tax is being collected on the $10 sunglasses? ($0.45 or 45 cents)

- 45 cents is what percentage of $10? (It’s 4.5%)

- What is the sales tax rate for our local area? (Varies based on location.)

10.2: Shopping in Two Different Cities (20 minutes)

Activity

In this activity, students work with tax rates. Because students reason repeatedly about the same percentage of different quantities, they have the opportunity to represent this process as an equation of the form \(y = kx\) (MP8). Students should see connections to their previous work with percent increase. As students work, monitor for different strategies, especially students who note that they can always multiply by the same factor and students who set up and use an equation.

In this activity, the tax rates are whole percentages so that students do not have to deal with rounding. The next activity deals with a tax rate that is a fractional percentage.

Launch

Provide access to calculators. Arrange students in groups of 2. Make sure students understand the situation by asking questions like, "How much would you have to pay for the paper towels in City 1? And for the lamp in City 2?" ($8.48 and $27)

Tell students, "In some places, there are different sales tax rates for different types of items (clothing, food, medicine, cars, etc.), but the cities in this question have a single sales tax rate for all items."

Give students 3–5 minutes of quiet work time. Afterwards, give students the option to work with a partner or to continue to work alone. Follow with a whole-class discussion.

Design Principle(s): Support sense-making

Student Facing

Different cities have different sales tax rates. Here are the sales tax charges on the same items in two different cities. Complete the tables.

City 1

| item | price (dollars) |

sales tax (dollars) |

total cost (dollars) |

|---|---|---|---|

| paper towels | 8.00 | 0.48 | 8.48 |

| lamp | 25.00 | 1.50 | |

| pack of gum | 1.00 | ||

| laundry soap | 12.00 | ||

| \(x\) |

City 2

| item | price (dollars) |

sales tax (dollars) |

total cost (dollars) |

|---|---|---|---|

| paper towels | 8.00 | 0.64 | 8.64 |

| lamp | 25.00 | 2.00 | |

| pack of gum | 1.00 | ||

| laundry soap | 12.00 | ||

| \(x\) |

Student Response

For access, consult one of our IM Certified Partners.

Activity Synthesis

Select previously identified students to share the sales tax they calculated for laundry soap in each city. Have students share how they calculated the sales tax.

Have some students share the expressions for the last row of each tables. Make sure students see the connection between this row and their previous work on percent increase. Point out that sometimes we want to know just the amount of the tax, \(0.06x\), and sometimes we want to know the total cost, which is the price plus the cost, \(x + 0.06x = 1.06x\).

Tell students that, when there is a certain tax that gets applied to a class of goods, it is called a tax rate. Tax rates are usually described in terms of percentages.

Supports accessibility for: Language; Social-emotional skills

10.3: Shopping in a Third City (5 minutes)

Optional activity

The purpose of this activity is for students to encounter a situation in which rounding error makes it look like the relationship between the price of an item and the sales tax is not quite proportional. Students should realize this is due to having a fractional percentage for the tax rate and the custom of rounding dollar amounts to the nearest cent.

Launch

Provide access to four-function calculators. Keep students in the same groups of 2. Allow students 2 minutes quiet work time followed by partner and whole-class discussions.

Again, tell students that the tax rate for items in City 3 is the same for all types of items.

Supports accessibility for: Memory; Organization

Student Facing

Here is the sales tax on the same items in City 3.

| item | price (dollars) |

sales tax (dollars) |

|---|---|---|

| paper towels | 8.00 | 0.58 |

| lamp | 25.00 | 1.83 |

| pack of gum | 1.00 | 0.07 |

| laundry soap | 12.00 |

- What is the tax rate in this city?

- For the sales tax on the laundry soap, Kiran says it should be $0.84. Lin says it should be $0.87. Do you agree with either of them? Explain your reasoning.

Student Response

For access, consult one of our IM Certified Partners.

Anticipated Misconceptions

Some students may say that the relationship is not proportional. Remind them of the activity in a previous unit where they measured the length of the diagonal and the perimeter of several squares and determined that there was really a proportional relationship, even though measurement error made it look like there was not an exact constant of proportionality.

Some students may say that the tax rate is exactly 7%. Prompt them to calculate what the sales tax would have been for the paper towels and the lamp if the tax rate were exactly 7%.

Some students may use 7.25% as the tax rate since that is what comes from the first item (paper towels) without checking this number against the tax on the other items provided. Prompt students to use the additional information they have to check their answer before proceeding to solve the row with laundry soap.

Activity Synthesis

Remind students about when measurement error made it look like the relationship between the length of the diagonal and the perimeter of a square was not quite a proportional relationship.

Consider asking these discussion questions:

- "How did you determine the tax rates for the items in City 1 and City 2 from the previous activity?" (Divide the sales tax by the price.)

- "How did determining the tax rate for City 3 differ from the work you did for the other cities?" (Since the tax rates were not the same for each item, I had to determine what tax rate might give each value listed.)

Tell students that, when multiple pairs of values are known (as in this activity or the previous one), they should work to find an exact tax rate as they did here. If only 1 pair of values is known (as in the following activities), they may use the exact tax rate found from that pair of values. For example, if this activity had only given the price and sales tax for paper towels, we may assume that the tax rate is 7.25%.

Design Principle(s): Maximize meta-awareness

10.4: Dining at a Restaurant (10 minutes)

Activity

In this activity students use previously learned strategies to solve problems involving fractional percentages. Monitor for students using various strategies (double number line, table, unit rate, equation) and identify students using an equation of the form \(y=kx\), especially to solve the last problem.

Launch

Keep students in groups of 2. Tell students that in some restaurants, people pay the server a tip in addition to paying for the meal. Tips usually range between 10% and 20% of the cost of the meal. Provide access to calculators. Give students 3–5 minutes of quiet work time, followed by partner and whole-class discussion.

Supports accessibility for: Organization; Attention

Student Facing

-

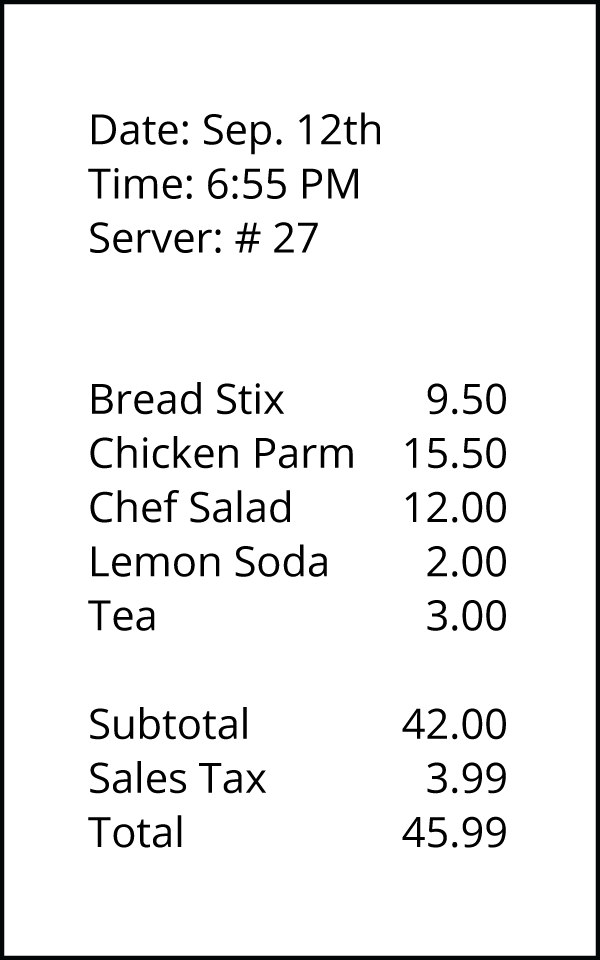

Jada has a meal in a restaurant. She adds up the prices listed on the menu for everything they ordered and gets a subtotal of $42.00.

- When the check comes, it says they also need to pay $3.99 in sales tax. What percentage of the subtotal is the sales tax?

- After tax, the total is $45.99. What percentage of the subtotal is the total?

- They actually pay $52.99. The additional $7 is a tip for the server. What percentage of the subtotal is the tip?

- The tax rate at this restaurant is 9.5%.

Another person’s subtotal is $24.95. How much will their sales tax be?

Some other person’s sales tax is $1.61. How much was their subtotal?

Student Response

For access, consult one of our IM Certified Partners.

Student Facing

Are you ready for more?

Elena's cousins went to a restaurant. The part of the entire cost of the meal that was tax and tip together was 25% of the cost of the food alone. What could the tax rate and tip rate be?

Student Response

For access, consult one of our IM Certified Partners.

Anticipated Misconceptions

Students may attempt to write an equation, but place numbers in the wrong place. Ask them what each piece of their equation means in this situation. In particular, monitor for students who struggle with understanding the second part the first question. Help these students understand by rephrasing the question as, "The total is what percentage of the subtotal?" and helping them to see that the answer should be greater than 100% since the total is greater than the subtotal.

Students might need a way to keep track of all the information. Suggest using a table that keeps track of original price and percent.

Activity Synthesis

Select students to share who used different strategies to solve the problems. Sequence them to show solutions that use diagrams first, then an equation like \(y=kx\).

If no student uses the equation strategy ask students:

- "How we might use an equation to solve the problem?"

- "What are the two quantities being used in these problems?" (Sales tax and subtotal or tip and subtotal.)

Demonstrate to students how to use the equation to solve a problem.

Help students connect the different strategies.

Design Principle(s): Support sense-making

Lesson Synthesis

Lesson Synthesis

Students should understand that we reason about fractional percentages like 0.8% and 110.5% using the same strategies we did with percentages that were whole numbers, like 37%. Ask students:

- “Where did we see and use fractional percentages in this lesson?” (Sales tax)

- “What are strategies we can use to calculate fractional percentages (including sales tax)?” (Double number lines, tables, an equation)

10.5: Cool-down - A Restaurant in a Different City (5 minutes)

Cool-Down

For access, consult one of our IM Certified Partners.

Student Lesson Summary

Student Facing

Many places have sales tax. A sales tax is an amount of money that a government agency collects on the sale of certain items. For example, a state might charge a tax on all cars purchased in the state. Often the tax rate is given as a percentage of the cost. For example, a state's tax rate on car sales might be 2%, which means that for every car sold in that state, the buyer has to pay a tax that is 2% of the sales price of the car.

Fractional percentages often arise when a state or city charges a sales tax on a purchase. For example, the sales tax in Arizona is 7.5%. This means that when someone buys something, they have to add 0.075 times the amount on the price tag to determine the total cost of the item.

For example, if the price tag on a T-shirt in Arizona says \$11.50, then the sales tax is \((0.075) \boldcdot 11.5 = 0.8625\), which rounds to 86 cents. The customer pays \(11.50 + 0.86\), or \$12.36 for the shirt.

The total cost to the customer is the item price plus the sales tax. We can think of this as a percent increase. For example, in Arizona, the total cost to a customer is 107.5% of the price listed on the tag.

A tipis an amount of money that a person gives someone who provides a service. It is customary in many restaurants to give a tip to the server that is between 10% and 20% of the cost of the meal. If a person plans to leave a 15% tip on a meal, then the total cost will be 115% of the cost of the meal.